- May 31, 2019

- Posted by: CA Amritpal Singh

- Category: Compliance, Taxation, Uncategorized

No Comments

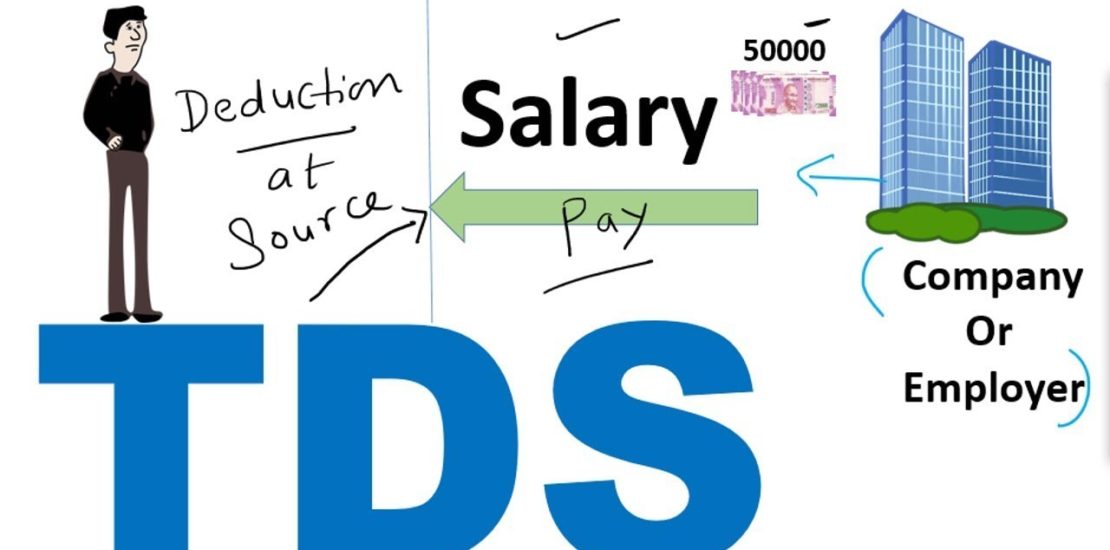

TDS On Salary

Section -192

- TDS has to be deducted on the estimated income of employee at the average rate of Income-tax computed on the basis of rates in force for that financial year. There is no TDS on salary if the annual salary of employee is below maximum amount not chargeable to tax

- The tax to be deducted from the salary payable in foreign currency shall be calculated in INR. The salary paid in foreign currency shall be converted into Rupees (INR) as per the “Telegraphic Transfer Buying Rate” prevailing on the date on which tax is required to be deducted.

- If employee does not furnish his PAN, the employer shall deduct tax at higher of the following rates:

- a) at the rate of 20% or

- b) Average Rate Computed as per slab

- The employer shall take into consideration the following exemptions and deductions for the purpose of TDS on salary calculation:

- a) Exemptions covered under Section 10 (HRA, Conveyance Allowance, other allowances or perquisites exempt from tax, etc.)

- b) Deductions allowed under Chapter VI-A (Section 80C to 80U)

Employer shall obtain proof and evidences from employee before allowing exemptions and deductions in calculation of TDS on Salary in Form 12BB.

- In case an employee is employed by more than one employer during the financial year, he may furnish the details of salary due or received from one employer to another employer in Form 12B. In that case, the tax will be deducted on the aggregate salary by one of the employers to whom the information is furnished.

- An employee may provide details of his other income and loss under the head ‘Income from House Property’ to the employer for the purpose of calculating tax to be deducted at source. It would be employer’s responsibility to consider the other income and check all documents for allowing deduction for losses.

- The Deductor shall furnish to Employee, a statement giving correct and complete particulars of perquisites or profits in lieu of salary and the value thereof in,—

| (a) | relevant columns provided in Form No. 16, if the amount of salary paid or payable to the employee is not more than one lakh and fifty thousand rupees; or | |

| [(b) | Form No. 12BA, if the amount of salary paid or payable to the employee is more than one lakh and fifty thousand rupees, which shall accompany the return of income of the employee.]

|

- Where Non-Residents are deputed to work in India and taxes are borne by the employer, if any refund becomes due to the employee after he has already left India and has no bank account in India by the time the assessment orders are passed, the refund can be issued to the employer as the tax has been borne by it [Circular No. 707 dated 11.07.1995].

- In respect of non-residents, the salary paid for services rendered in India shall be regarded as income earned in India. It has been specifically provided in the Act that any salary payable for rest period or leave period which is both preceded or succeeded by service in India and forms part of the service contract of employment will also be regarded as income earned in India.

- Deductor cannot consider any deduction u/s 80G, even if it is paid through the employer. Employees have to claim the same by themselves while filing the return of income.

FOR DETAIL WORKING REFERCircular No. 01/2019 dated 1st January, 2019

For any Query on TDS ask our experts on mail@maksimconsultants.com